TOURS TO EGYPT, GREECE & MORE!

WELCOME TO PTM TOURS!

We run small, personalized group tours for people that are interested in exploring new destinations without having to deal with all the planning and logistics.

AS SEEN IN…

About PTM Tours

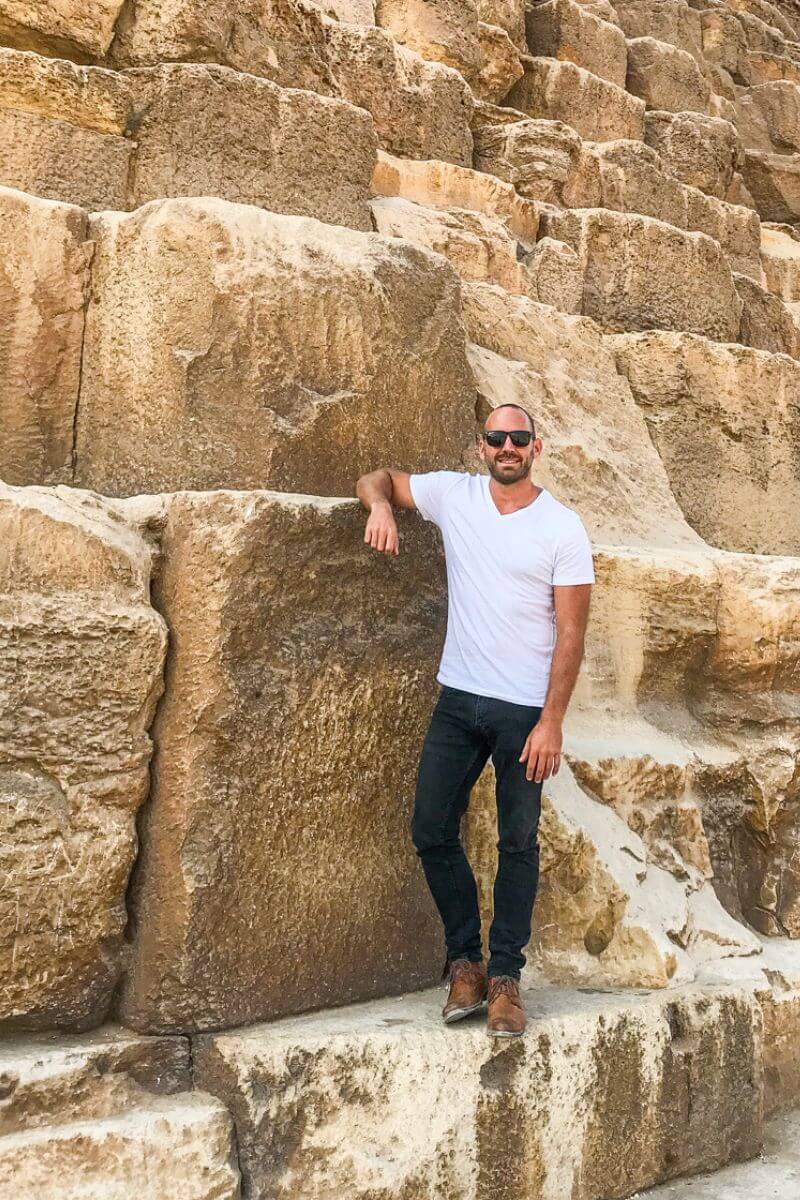

My name is Ryan Gargiulo and I have spent the last 16 years traveling to more than 75 countries around the world.

After multiple trips to Egypt and realizing how difficult it is to travel the country independently, I announced the first annual Experience Egypt Tour (2017) and it sold out out in less than four days!

Seven years and multiple sold out tours later, I now operate annual tours in both Egypt and Greece with plans to introduce new and exciting destinations for 2025!

— Tours —

We have two incredible tours planned for 2024 — Experience Egypt & Experience Greece.

Learn more about each individual tour by viewing the detailed itineraries below.

Experience Greece Tour

June 11th-18th, 2024 — SOLD OUT!

Trip Length: 8 Days / 7 Nights

Guests: 13

The Experience Greece Tour is the perfect introduction to Greece — with visits to Athens, Milos and Santorini.

Some of the highlights of this tour include a guided walking tour of the Ancient Acropolis & Acropolis Museum, a day at sea on a private sailboat in Milos and two nights in a private hotel just for us on the edge of the cliffs in Santorini.

Experience Egypt Tour

October 6th-14th, 2024

Trip Length: 9 Days / 8 Nights

Guests: 18

The Experience Egypt Tour is one of the best ways to truly experience everything that Egypt has to offer without all the extra hassle. This itinerary includes the visits to Cairo, Aswan and Luxor.

Some of the highlights include a guided tour to the Pyramids of Giza, Sphinx and Saqqara, Grand Egyptian Museum (GEM), Muhammad Ali Mosque, an all-inclusive 3-night Nile Cruise from Aswan to Luxor with visits to Karnak and Luxor Temple, Valley of the Kings, Hatshepsut, an optional sunrise hot air balloon ride over the Nile and so much more.

Such an incredible experience!

Stefanie Lewis

Massachusetts, USA

“Such an incredible experience! I loved every moment of our time in Greece. Thank you for another amazing trip Ryan!

One of my favorite parts of doing tours with you Ryan is exactly what Diane said… you start off as strangers and end as family. I’m so grateful for the wonderful friends I’ve made through the two tours I’ve done with you.”